Good recordkeeping allows an organization to know the amount of income they have received. It will also track when it was received and the source it was received from as well as how and when that income was spent.

Cash or Accrual Basis

Organizations record their financial activities using either the cash or accrual basis of accounting.

For the cash basis, revenue and expenses are recorded when cash is received or expenses paid. For example, payment for services would be recorded when payment was received. Payment of bills would be recorded when the payment was actually made.

When an accrual basis is used, revenue is recorded when it is earned, and expenses are recorded when they are incurred. In this case, payment for services would be recorded when the organization delivered the services not when the organization got paid. Payment of bills would be recorded when the services were received by the organization. Under the accrual method of accounting, revenues may be received after the end of the fiscal period and expenses may be paid in the next fiscal year.

Tracking Money In & Out

If the organization is relatively small and operates only one program, a cheque book may be an adequate source to keep the financial records. As the organization grows, the number of transactions increase and a cheque book alone is not adequate. The two basic records needed are the cash receipts and cash disbursements journals. These accounting papers can be purchased in stationery stores. The columns in the journals should be labelled to correspond with the line items in the budget. Similar spreadsheets can also be created on Microsoft Excel.

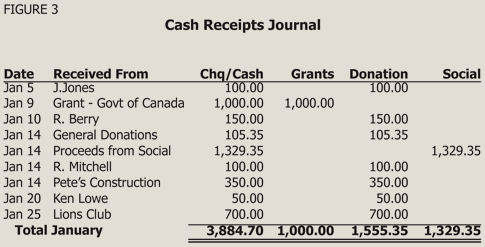

The cash receipts journal is a listing of all the cash receipts in the order they are received. Each amount is assigned a category that corresponds with the line item in the budget and categories are totalled each month. Below is an illustration of a cash receipts journal for January.

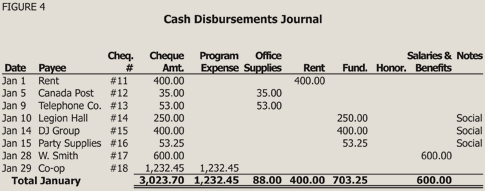

The cash disbursements journal, shown below, is a detailed listing of the cash spent and the expense category that it applies to. The expense categories should correspond with the line items in the budget and each category is totalled at the end of each month.

Information about actual income and expenditures should be compared with the budget on a regular basis to see if they are on track with budget projections. If they are not, action may have to be taken, such as reducing spending, if the expected income is not coming in.

Paying Bills

All invoices or bills should be approved by the person who knows why the expense was incurred by initialling the invoice before it is paid. Once paid, the cheque number and date are written on the invoice, and it is filed in numerical order. This ensures the invoice is not paid twice and can be found easily when required. If the organization writes more than 30 cheques a month, the invoices are usually filed alphabetically by supplier.

There should be two signatures on every cheque. Doing this ensures at least two people have the opportunity to look at the request for the expenditure and that the expenditure is in line with the budget. One of the signatures on the cheques should be the Treasurer and the other an officer of the Board or staff. In many organizations, three or four persons are authorized to sign cheques. In this case, if one person is away, the organization always has at least two people to sign cheques. All blank and cancelled cheques that are returned from the bank should be kept in a secure and preferably locked location. Cheques should not be signed without the cheque being completely filled in as this puts the organization's funds at risk.

Petty Cash

At any point in time, the amount of cash in the fund plus the petty cash vouchers (receipts) should always total the established petty cash balance. The petty cash should be checked periodically by someone other than the person in charge of petty cash to ensure the funds are properly managed.

A petty cash system is usually established for disbursements where the payments are too small to write a cheque. The amount of the petty cash fund is determined by the organization. It is usually from $50 to $200. A cheque is written for the amount and cashed. The petty cash is kept in a locked box and controlled by one person who is accountable for the funds.

A voucher is filled out whenever money is disbursed. It includes the date, person receiving the funds, reason for the disbursement and the amount of the transaction. The receipt is attached to the voucher. When the amount of cash runs low, the receipts are added up and a new cheque is written for petty cash. The receipts are summarized and expensed to appropriate categories.

Bank Reconciliations

Monthly bank reconciliations are important as it ensures that the cash balance on the books is correct. Banks sometimes make errors that need to be corrected and there may be some fees that need to be recorded. Bank statements list the deposits and withdrawals that have been made on the account for a month. Each deposit and cheque written should be checked against the bank statement.

Any cheques that have not cleared the bank should be deducted from the bank statement ending balance. Likewise, any deposits that are outstanding are added to the bank statement ending balance. In summary, the bank statement ending balance less outstanding cheques plus outstanding deposits should equal the cash balance on the books. Bank reconciliations are usually filed with the bank statements and the cancelled cheques by month.

Internal Controls

It may be helpful for the organization to review its overall cash receipts and disbursement process with an accountant. This is to ensure that the major elements of internal control are not missing. Internal controls are procedures adopted by the organization to prevent fraud, detect errors and to make sure that money is being spent in a way that the organization wants it to be spent.

One basic element of internal control is that no one person should handle all aspects of any financial transaction. This is referred to as the segregation of duties. It creates an internal system of checks and balances. For example, the person who approves a bill to be paid is not the same person who signs the cheque to pay it. In small organizations, however, it may not be practical to involve several people in the financial transactions.